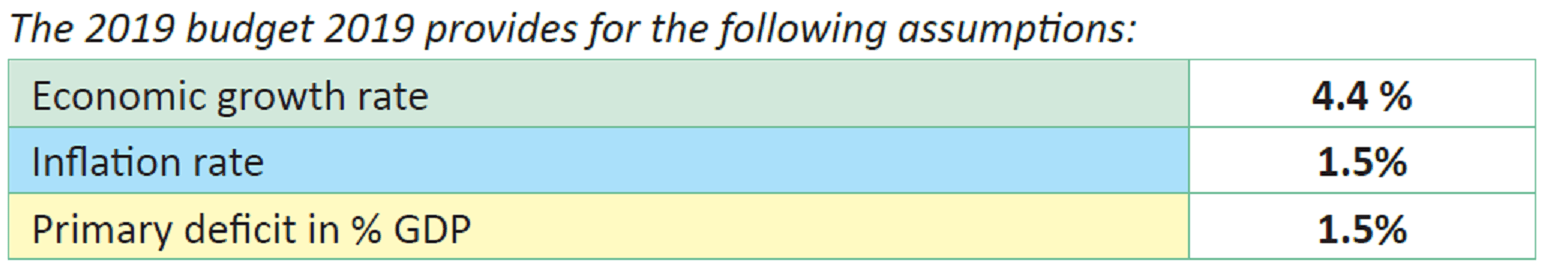

The economic assumptions in the budget reflect the government’s expectations in terms of growth, inflation, revenue and other factors. They are based on statistical calculations and estimates.

For the year 2019 the objectives are:

| At the economic level | At the social level | At the level of state governance |

| – Improving the energy sector

– Helping companies to improve their competitiveness – Support the development of local industries – Support agriculture, livestock, and agriculture-based industry – Help small and medium-sized enterprises to find financing for their activities |

– Improving access to social services

– Strengthen civic education and language teaching – Promoting the culture of living together – Protect the most vulnerable people (i.e. help them find work and provide them with vocational training sessions and other actions) |

– Improve government management and performance

– Use public money more efficiently – Improve revenue collection – Limiting the State’s indebtedness – Reduce the budget deficit |

In order for the State to achieve its objectives, it seeks to maximize its revenues. To this end, each year the government adopts measures to increase its capacity to collect revenue.

For the year 2019, the main orientations are:

| Expand the tax base | This will allow the State to increase its revenues from taxes |

| Secure recipes | This will enable the State to ensure that the revenue provided for in the budget will be collected and available |

| Fight against fraud and tax evasion | This will allow the State to prevent individuals and companies from evading the payment of taxes and duties |

| Improve the business climate | This will attract and create new businesses that will generate taxable activities and income. So even more revenue for the State |

| Socio-economic promotion | Mostly tax incentives to encourage young people, vulnerable people and businesses to work. |

The State also seeks to avoid the waste of public money by following guidelines to ensure that its expenditures are effective.